In recent months, a noticeable trend has emerged: investors are moving capital from traditional asset classes into hotel and commercial real estate. And it’s not just a passing wave—the foundations of this shift are deeply rooted in stability, long-term returns, and lower volatility compared to more dynamic financial instruments.

Table of Contents

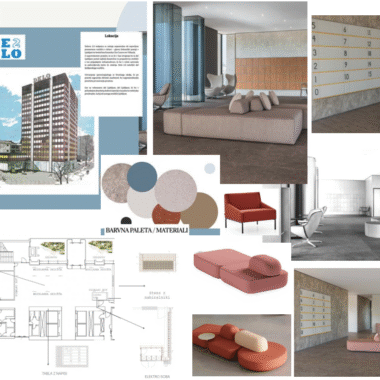

Just look at Ljubljana. The city is currently witnessing the construction of its most expensive real estate development to date—a massive €350 million project—and it’s no coincidence.

Why the Growing Interest in Commercial Real Estate?

For investors, predictability is key. Commercial properties, especially hotels and office buildings, often come with long-term lease agreements and consistent demand, which provide steady cash flow. Compared to stocks or bonds, commercial real estate is less sensitive to short-term market shocks—making it an increasingly attractive haven in today’s uncertain global economy.

Even during turbulent periods marked by trade disputes or geopolitical instability, real estate has proven to be resilient. It’s one of the few asset classes that maintains its value even when global markets are shaken.

Moreover, returns from commercial properties tend to be higher on average, driven by stronger rental yields and longer lease durations. These factors make real estate an ideal option for those seeking portfolio diversification and reliable income streams.

Record-Breaking Tourism in Slovenia 🇸🇮

Tourism plays a crucial role in this trend. In April 2025, Slovenia achieved a historic record in tourism:

- 490,300 tourist arrivals (+22.5% year-over-year)

- 1.14 million overnight stays (+21.8%)—the most ever recorded in April

The growth isn’t just seasonal. In the first four months of 2025, Slovenia welcomed:

- 1.4 million tourists

- 3.5 million overnight stays, representing 6% and 4% growth respectively over the previous year

Foreign tourists drove this boom, making up 65% of total overnight stays. Popular destinations like Ljubljana, Piran, and Bled attracted nearly half of all foreign overnight stays, with increases of 28%, 48%, and 31% respectively.

Rising Demand for Modern Infrastructure

The rapid growth in tourism is directly influencing the commercial property market. Hotels, apartments, office spaces—modern, well-located infrastructure is in high demand.

Key growth indicators:

- Hotels accounted for 53% of all overnight stays (+20%)

- Private rentals (rooms, apartments, homes) saw 31% growth

- Campsites grew by 29%

- Mountain municipalities recorded the highest growth at +37%, followed by Ljubljana (+26%) and coastal areas (+22%)

As demand increases, so does the value of commercial real estate, particularly in hospitality, retail, and service industries. Properties with stable, long-term tenants—like hotel chains and corporate office clients—offer predictable returns and reduced risk, making them highly attractive for strategic investment.

EQUINOX: Opening Real Estate Investment to Everyone 🏙️

One standout player in this space is #EQUINOX—a real estate investment company that focuses on hotel and commercial properties in central Ljubljana.

What makes Equinox unique?

They democratize access to real estate investments, allowing you to start with as little as €2,000, €5,000, €10,000, or €30,000—no need for hundreds of thousands in capital.

Their portfolio is the largest and most centrally located in the capital of any EU member state. In fact, every property is located within 300 meters of Prešeren Square, the very heart of Ljubljana.

Didn’t catch their live presentation of Q1 2025 business results?

You can still watch the recording here and gain insight into their impressive performance:

✅ Sales: +38.1%

✅ EBITDA: +50.4%

✅ FFO: +26.3%

Final Thoughts

The rising tourism numbers, increasing demand for commercial space, and consistent performance of real estate assets point toward a clear trend: commercial real estate in Slovenia is thriving.

Whether you’re an institutional investor or someone looking to enter the market with a modest amount, the opportunities are growing—and becoming more accessible than ever.